This market could go much weaker with SPY forming a bearish flag formation. Breakdown could see 106.74, the S3 @ 102.20. Trade with caution and trade quickly. RSI and STO are also declining.

Thursday, September 29, 2011

Wednesday, September 28, 2011

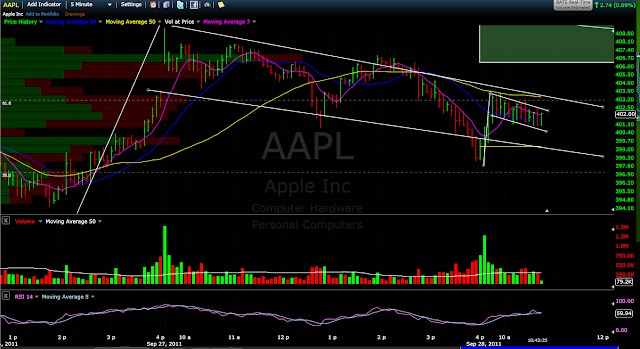

$AAPL Bull Flag

We got a bull flag on the 1 minute and 5 minute chart setting up.

This is bullish look for BO ouf 1 minute to test resistance of the 5 minute. Next resistance after is overhead downtrend line.

This is bullish look for BO ouf 1 minute to test resistance of the 5 minute. Next resistance after is overhead downtrend line.

Tuesday, September 27, 2011

RECAP: Cautionary Note About Today's Market Rally

While the market finished up today 147 points many major players either sat this rally out, or traded down. After Apple's GAP UP it steadily sold off finishing the day -1%. Amazon was also weak today finishing the day down nearly -2.5%. Chipotle steadily sold off throughout the day and closed at -2.7%. FAZ (Direxion Financial Bear 3x Shares) GAPED DOWN at the open nearly $5 and had a huge late day surge at 2:30pm @ 56 and closing the day @ 60.37 at HOD. XLF the SPDR FINANCIAL ETF did the exactl opposite (as its supposed to do) selling off hard into the close 2%. SPX finished the day @ 1175 up 1%, but sold off hard into the close starting at around 2:30pm dropping nearly 20 points, or about 2%.

My Take on all this is too be cautious and nimble with your trades going forward these next few days. I am skeptical of markets where the leaders lag. This was an unusual +150 close and will treat it as such.

My Take on all this is too be cautious and nimble with your trades going forward these next few days. I am skeptical of markets where the leaders lag. This was an unusual +150 close and will treat it as such.

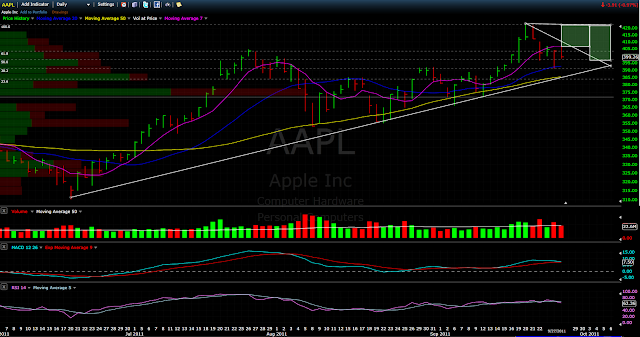

AAPL Earnings Swing Play

This Daily chart of $AAPL shows a consolidation pattern forming. A breakout to the upside I believe ill be coming in the next few days on IPhone announcement, barring any software or technical errors. At which point I Believe $AAPL will trade within the boxes in the chart until the upcoming earnings call. Which should move the stock price up in anticipation. $AAPL will become a long swing when it breaks out above 422.85 (previous high).

My Trading Plan: will go long on consolidation BO, bc I believe it will re-test highs : target 420. Then it should consolidate within the green box before taking out previous highs in earnings move.

I am also LONG Oct. 22, 2011 395 @ 17.70 for earnings push. Might let these expire, or cash out early.

My Trading Plan: will go long on consolidation BO, bc I believe it will re-test highs : target 420. Then it should consolidate within the green box before taking out previous highs in earnings move.

I am also LONG Oct. 22, 2011 395 @ 17.70 for earnings push. Might let these expire, or cash out early.

AAPL Intraday Chart

AAPL has been trading predictably over the last few hours holding previous Supp./Rest. levels.

My next long entry is a Limit Buy Order @ 406.01 looking for quick move for +.80

My next long entry is a Limit Buy Order @ 406.01 looking for quick move for +.80

Following the Right People

Following the right people, both on twitter and stocktwits is very important. They can provide excellent trade ideas, watch lists, and general market information and news. More so, they can be invaluable teachers.

Here is a list in no particular order of must follows (IMO):

JonathanFlorida

Gtotoy

Crosshairtrader

alphatrends

PipCzar

CarsonDahlberg

TodayTrader

UpsideTrader

AllStarCharts

DayTrend

aztecs99

downtowntrader

harmongreg

traderstewie

tickerville

apextrader

tradefast

biggercapital

traderflorida

1vestor

chartly

apextrader

These people provide an excellent source of information, news, set-ups, and alerts.

Can't go wrong with all the knowledge on that list.

Trade'Em Well

Here is a list in no particular order of must follows (IMO):

JonathanFlorida

Gtotoy

Crosshairtrader

alphatrends

PipCzar

CarsonDahlberg

TodayTrader

UpsideTrader

AllStarCharts

DayTrend

aztecs99

downtowntrader

harmongreg

traderstewie

tickerville

apextrader

tradefast

biggercapital

traderflorida

1vestor

chartly

apextrader

These people provide an excellent source of information, news, set-ups, and alerts.

Can't go wrong with all the knowledge on that list.

Trade'Em Well

Verified Apple ( $AAPL ) Trades Reviewed

Used the daily chart to see that $AAPL was coming down to its 20 day moving average 38.2 retrace, so I played the bounce or fail. It is important to also note, that Apple tanked early today some crap report by JP Morgan that Apple was slowing down production in China. Some things of note about this: 1. Analyst said he expected no impact on sales 2. The fact that Apple had just announced new plant in Brazil 3.The fact that Apple had UPPED its production in order to meet upcoming Holiday demand. This is an example of the Big Boys manipulating the stock in order for them to buy cheaper. LESSON: AVOID THE NOISE!

|

| Click Chart to Expand |

|

| Click Chart to Expand |

|

| Click to Expand |

"How to Make Money In Stocks"

Hope you didn't think I would be giving you the simple answer. But I am going to point you in the right direction. ------------------------->

This is the most influential book I have ever read. Put simply, this book has returned its investment 300,000% I'd say it was money well spent.

So I figured what would make a better Introductory blog post than sharing with any and everyone that reads THE most important book to my young trading career. I will not give you the bullet points or a summary except to say that PRICE and VOLUME is everything!

If your serious about trading then you must read this book. It provides a no nonsense approach to trading with clear and definable objectives and analysis.

Truth is NOBODY has a crystal ball and anyone claiming to have a "sure thing" "100%" "Can't Lose" is full of "it". The best one could do is put themselves in the best possible position to win. Think of card counters in Vegas. They don't win 100% of the time, but what they can do is improve their odds of success from 50 to 75%, and when you have statistics on your side (and my friend numbers DON'T lie), that's how the money is made. And that's what this book gives you. It allows you to improve your odds of success from 50/50, essential when your going up against the Big Boys (Wall St.) with loaded decks.

This is the most influential book I have ever read. Put simply, this book has returned its investment 300,000% I'd say it was money well spent.

So I figured what would make a better Introductory blog post than sharing with any and everyone that reads THE most important book to my young trading career. I will not give you the bullet points or a summary except to say that PRICE and VOLUME is everything!

If your serious about trading then you must read this book. It provides a no nonsense approach to trading with clear and definable objectives and analysis.

Truth is NOBODY has a crystal ball and anyone claiming to have a "sure thing" "100%" "Can't Lose" is full of "it". The best one could do is put themselves in the best possible position to win. Think of card counters in Vegas. They don't win 100% of the time, but what they can do is improve their odds of success from 50 to 75%, and when you have statistics on your side (and my friend numbers DON'T lie), that's how the money is made. And that's what this book gives you. It allows you to improve your odds of success from 50/50, essential when your going up against the Big Boys (Wall St.) with loaded decks.

Monday, September 26, 2011

DISCLAIMER

I DO NOT MAKE RECOMMENDATIONS TO BUY OR SELL SECURITIES - I JUST POST TRADES I MAKE OR FIT THE RULES OF MY TRADING PLAN ON A DAILY BASIS. DO YOUR OWN DUE DILIGENCE - YOU ARE RESPONSIBLE FOR YOUR TRADES, INVESTMENTS, AND DECISIONS! ALL CHARTS COURTESY OF E*TRADE, STOCKCHARTS.COM, CHART.LY, & FREESTOCKCHARTS.COM.

Subscribe to:

Posts (Atom)